Payday Lending Reform

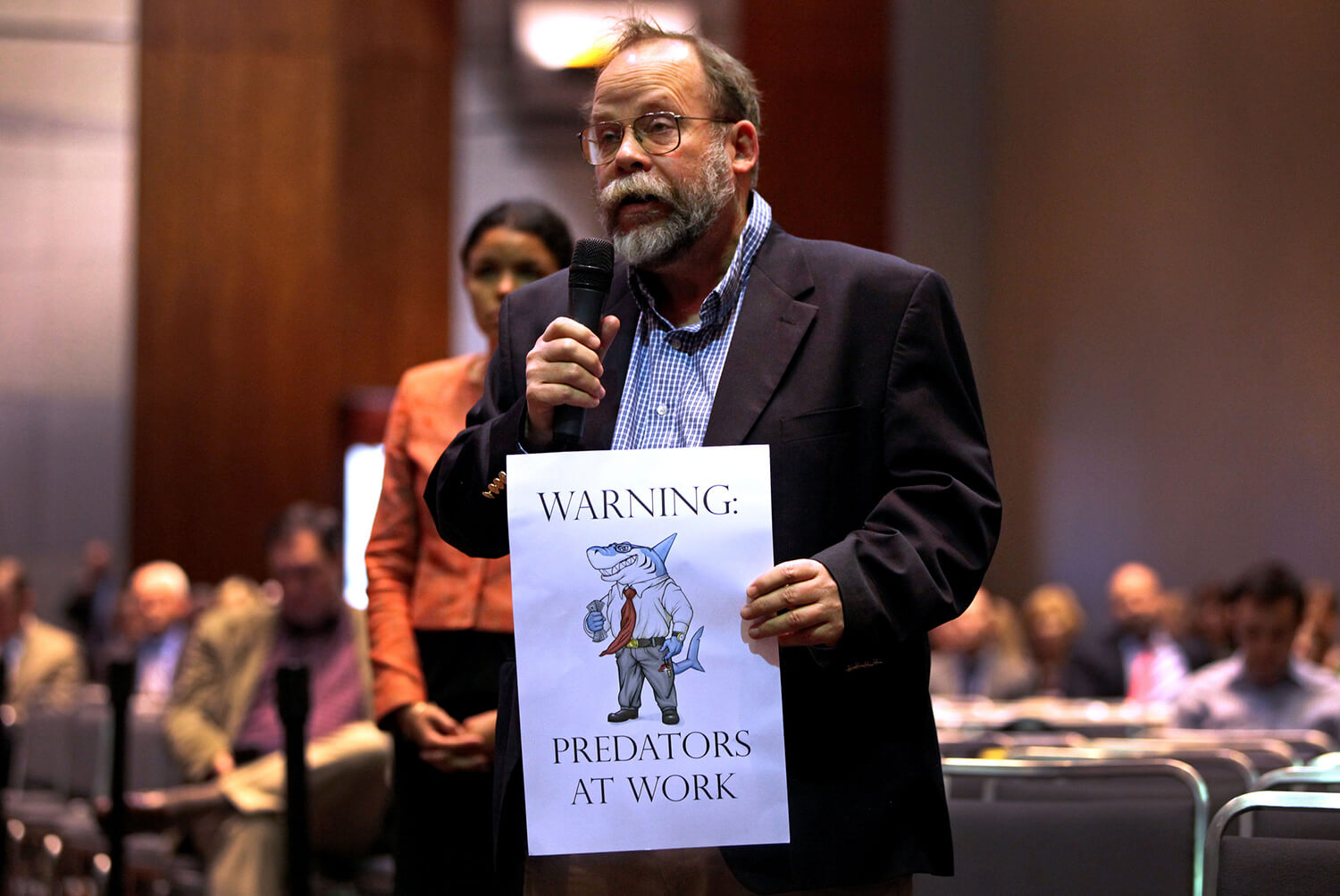

Protecting Washington consumers by ending predatory payday lending.

Economic Justice – Policy Reform

OVERVIEW

After the legalization of payday lending by the Washington Legislature in 1996, hard-working people frequently became ensnared in the payday lending “debt trap”, which results when payday loan customers repeatedly take out new loans to pay off old payday loans.Many borrowers in Washington, most of them low-income, took out dozens of payday loans each year, with interest rates as high as 391%. Columbia Legal Services helped to pass successful legislation in 2010 that halted the most predatory practices of the industry.

TEAM

Stopping Predatory Payday Lending Through Policy Reform

After the legalization of payday lending by the Washington Legislature in 1996, hard-working people frequently became ensnared in the payday lending “debt trap”, which results when payday loan customers repeatedly take out new loans to pay off old payday loans. According to a 2003 report by the Center for Responsible Lending, 91% of all payday loans nationally were made to repeat borrowers with five or more loans per year. Many borrowers in Washington, most of them low-income, took out dozens of payday loans each year, with interest rates as high as 391%.

Columbia Legal Services helped to pass successful legislation in 2010 that halted the most predatory practices of the industry. The legislation (HB 1709) limited payday loans to one loan at a time and no more than eight payday loans per customer per year. These provisions stopped the “debt trap” in our state. Columbia Legal Services continues to monitor and fight off efforts to scale back this landmark consumer protection legislation.